A year ago I wrote an article about why trend following doesn’t work on stocks. That article surprised many people. After all, I was mostly known for writing a book about trend following on futures. Why would I diss trend following? And why does a futures guy talk about stocks? The fact is that I’ve been working with stocks longer ...

Read More »Is your risk random?

Your trading model might have a random risk element and you might not even be aware of it. In particular longer term models need special care to avoid ending up with random risk. The world doesn’t stop spinning when you open a position. The assumptions you used when opening your position may not be valid a week later. Even less so ...

Read More »Beating the Index with Minimum Rules

Do you want to beat the index with just a few lines of code? You don’t even need to program it. It’s simple enough to do manually. Beating the index is probably not the right term though. Killing it might be a better word. Beating the index is supposed to be very difficult. After all, around 80-90 percent of all ...

Read More »Twelve Months Momentum Trading Rules – Part 2

Earlier this week I published a simple 12 month momentum model which shows surprisingly good performance. The rules used are so simple that many of you are probably doubting the results. Perhaps you want a closer demonstration? Let’s take a look at the details of this model and see if it really works. First, let’s revisit the rules. Every Friday ...

Read More »May Trend Following Performance

Let me start by apologizing for the absence of posts for a while. My ‘day job’ of running our asset management shop has taken precedence in this turbulent times, along with my hobby project TradersPlace.net. Next week, on Wednesday the 26th of June, I’ll be in London speaking at the Battle of the Quants. Hope to see you there. Ok, ...

Read More »Updating ‘Following the Trend’ Core Strategy for 2012

I was recently questioned about how the strategy I present in Following the Trend did in 2012. Those who read it may recall that the analysis ends as of December 2011. It should come as no surprise that last year was bad. 2012 spelled trouble for most trend followers and most CTA hedge funds set new all time max draw ...

Read More »Available on Amazon.com from Today

The hard cover version of Following the Trend is available from today on Amazon.com. The Kindle has been available for download for a couple of days and is currently the number 3 best seller in the category Futures on Amazon. What does it mean to be number three in this category? I have absolutely no idea. If you haven’t done ...

Read More »Legendary Turtle Trader on Following the Trend

In the beginning of the 1980’s two of the most successful and more admired traders in the business were caught in a friendly argument. The discussion was regarding trading skills. One claimed you need to be born with the right skills. The other claimed that this can be taught. It was a classic nature vs. nurture argument. They were unable ...

Read More »Trend Followers Hit New Lows

Is trend following dead in the water? Has the concept stopped working? Are we seeing the death of the CTA industry and a return to traditional investments? Fair questions. Let’s look closer before answering them. The industry is certainly going through a very tough period. This is the second bad year in a row and the cumulative drawdowns are adding ...

Read More »August CTA Performance Roundup

Trend following hedge funds mostly showed small changes in August. A few however showed rather large swings. August was a month where the asset mix really mattered. I have stated before that the key factor separating these funds is asset mix. The entry and exit rules are more or less the same for all trend followers. Tweaking the details is ...

Read More »Flat August after Bonds Stopped Early

Trend followers will show quite mixed performance for August. Most months are about the overall picture. This month was all about the tiny details. August was a rare month where luck made the difference between up or down. Have you ever taken a stop on a trade only to see it turn right back up again? This is what happened ...

Read More »Leverage Schmeverage!

Is it risky to be 150% leveraged? How about 1500%? It’s the wrong question to ask. Leverage and risk are not necessarily connected. A common argument against trend following hedge funds is that they are too leveraged. This is based on a lack of understanding of leverage. Most people who bring up this argument are just used to one asset ...

Read More »Strong July Trend Following Performance

It’s been a rocky year for trend followers so far and our core strategy is just barely above zero for the year. July was very good and so far all CTA funds I follow came in with strong numbers, as could be expected and predicted by the core strategy. Early in the year the trend followers as a group were ...

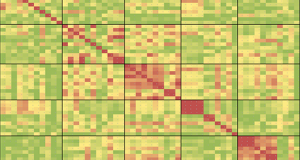

Read More »How to Build Correlation Matrices

They key to trend following is to be very diversified, so that your return curve moves up in a reasonably smooth manner. What you need to ask yourself however is whether you are holding a real diversified portfolio or just a very expensive illusion of safety. Everyone talks of increasing correlations the new risk on/risk off world, but few topics ...

Read More » Following the Trend

Following the Trend