It is a long established fact that a reasonably well behaved chimp throwing darts at a list of stocks can outperform most professional asset managers. While there would be obvious advantages with hiring chimps over hedge fund traders, such as lower salaries and better manners, there are also a few practical obstacles to such hiring practices. For those asset management ...

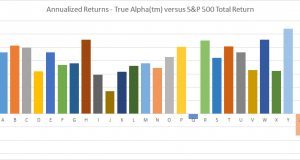

Read More »True Alpha – How the CLENOW portfolio makes a fool out of the S&P 500

Beating the index isn’t really all that hard. I’m going to show you a great way to beat the market while having some fun in the process. This is a brand new way of managing portfolios, and I’m going to explain every detail of it. The True Alpha method is easy to trade and is unique in offering personalized vanity ...

Read More »Beware of Trading Quotes

Retail traders love quotes. Boiling something down to a single sentence makes it appear as a universal truth. A physical law that cannot be broken. It’s a great way to reduce critical thinking. After all, if George Soros said something, it surely must be true. The guy is a billionaire and couldn’t possibly be wrong. Quotes are useless. Pay no ...

Read More »The Stock Investing Illusion

Most people trade stocks because it seems easy. We all know what companies do and how they stock work. At least, that’s what most people would think. It’s a dangerous and deceptive illusion. Equities seem attractive for two reasons. First because they appear simple, and second because of the common belief that stocks always appreciate over time. Both of these points ...

Read More »Mutually Assured Destruction

Almost all mutual funds in the world fail to do their job. You’ll find better odds at the racing track than you will buying mutual funds. So why do people still buy them? Almost everyone in the developed world has a stake in a mutual fund. Even if you didn’t actively buy into any mutual fund, your pension fund is ...

Read More »Trend following does not work on stocks

There’s a good reason why most professionals who apply models similar to trend following to stocks call them momentum models. It’s not just a clever rebranding, it’s really a very different game. To blindly cling to trend following as a religion, disregarding any real world evidence and attacking anyone presenting ideas that differ to the trend following mantra is not ...

Read More » Following the Trend

Following the Trend