A random number generator can beat your mutual fund. Given a choice between a random portfolio and a mutual fund, I’ll go with the randomizer every day of the week and twice on Sundays. You think I’m joking? I’m not joking. Trashing the mutual fund industry is almost like beating a dead horse. Except of course that it’s a thriving, ...

Read More »Articles

Beware of Trading Quotes

Retail traders love quotes. Boiling something down to a single sentence makes it appear as a universal truth. A physical law that cannot be broken. It’s a great way to reduce critical thinking. After all, if George Soros said something, it surely must be true. The guy is a billionaire and couldn’t possibly be wrong. Quotes are useless. Pay no ...

Read More »The Stock Investing Illusion

Most people trade stocks because it seems easy. We all know what companies do and how they stock work. At least, that’s what most people would think. It’s a dangerous and deceptive illusion. Equities seem attractive for two reasons. First because they appear simple, and second because of the common belief that stocks always appreciate over time. Both of these points ...

Read More »Stocks on the Move is Out!

A year ago I wrote an article about why trend following doesn’t work on stocks. That article surprised many people. After all, I was mostly known for writing a book about trend following on futures. Why would I diss trend following? And why does a futures guy talk about stocks? The fact is that I’ve been working with stocks longer ...

Read More »Why I am Self Publishing my New Trading Book

I’m one of the top 5% best selling trading book authors in the world. My first book was a run-away success. And yet I’m about to self publish my next work. Why would an established author want to self publish? There is an unjustified perception that self publishing means poor quality. Let me tell you why that’s not necessarily true. Publishing ...

Read More »Mutually Assured Destruction

Almost all mutual funds in the world fail to do their job. You’ll find better odds at the racing track than you will buying mutual funds. So why do people still buy them? Almost everyone in the developed world has a stake in a mutual fund. Even if you didn’t actively buy into any mutual fund, your pension fund is ...

Read More »Why managing your own money is a bad trade

A great trader who decides to manage just his own money made a poor trading decision. If you trade anyhow it’s irrational not to manage other people’s money. Living the dream Ok, let’s back up a few steps. Let’s assume that you’ve been trading for a while and you’re getting comfortable doing it. Perhaps you’re becoming pretty good or even ...

Read More »Why I’m not renewing my MTA membership

I’m a member of the Market Technicians Association (MTA) and a holder of their Chartered Market Technician (CMT) certification. But not for long. I had a good reason for joining and I have an even better reason for leaving. What I actually lack a good explanation for is why I remained a member for so long time. The MTA is ...

Read More »Are you trading or gambling?

Do you want to be a gambler or a professional trader? I’m guessing most people who read this would prefer the latter. But are you sure that you’re not a closet gambler? I used to read a lot of trading books. Back in the early 90’s I started the habit of reading large volumes of trading books. I read everything. ...

Read More »Is your risk random?

Your trading model might have a random risk element and you might not even be aware of it. In particular longer term models need special care to avoid ending up with random risk. The world doesn’t stop spinning when you open a position. The assumptions you used when opening your position may not be valid a week later. Even less so ...

Read More »A Counter Trend Indicator: Profit from Trend Followers’ Weakness

A good indicator is based on sound logic. It should try to quantify or visualize a concept that makes sense and is easily explainable. Mostly I use very simple indicators. The most basic of indicators can be very helpful if used rightly. The indicator I’m about to describe here is quite simple in concept but requires a few more steps ...

Read More »Why technical analysis is shunned by professionals

The poor reputation of technical analysis is well deserved. It’s their own fault really. The way this field has expanded makes it very difficult to take it seriously. It’s been reduced to a slogan used by scam artists to sell nonsense books, trading systems, newsletters and ‘mentoring’ based on quasi religious numerology and mysticism. Professionals stay clear of the term ...

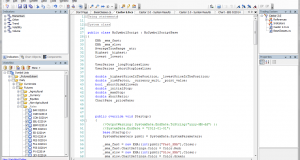

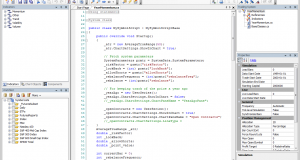

Read More »Why I prefer RightEdge for strategy modeling

Choosing a good platform for strategy modeling, simulations and signal generation is critical. The bleak reality is that most back testing software is horribly bad. They are geared towards consumers with limited knowledge and experience and they cater to what your average get-rich-quick technical analysis guru claims that you need. I’m often asked for my views on simulation platforms, and in ...

Read More »How to build a professional simulation environment – On the cheap

Do you want to learn how to build a professional environment for trading simulations without paying an arm and a leg? Building a proper environment for developing and testing trading strategies can be very expensive. It doesn’t have to be though, as long as you’re willing to put in some work. I work with both cheap and expensive tools and ...

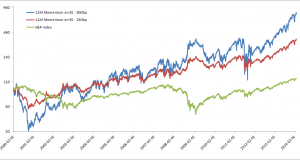

Read More »Trend following does not work on stocks

There’s a good reason why most professionals who apply models similar to trend following to stocks call them momentum models. It’s not just a clever rebranding, it’s really a very different game. To blindly cling to trend following as a religion, disregarding any real world evidence and attacking anyone presenting ideas that differ to the trend following mantra is not ...

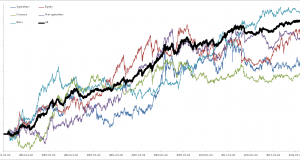

Read More »A study in diversification

Diversification can be a funny thing. It’s one of those things that sound so boring and mainstream that many people simply ignore them. Just something boring that the establishment wants us to do but really has no actual use. Kind of like taxes and seat belts. But diversification can actually be of use. It’s especially important for trend following strategies ...

Read More »Beating the Index with Minimum Rules

Do you want to beat the index with just a few lines of code? You don’t even need to program it. It’s simple enough to do manually. Beating the index is probably not the right term though. Killing it might be a better word. Beating the index is supposed to be very difficult. After all, around 80-90 percent of all ...

Read More »Twelve Months Momentum Trading Rules – Part 2

Earlier this week I published a simple 12 month momentum model which shows surprisingly good performance. The rules used are so simple that many of you are probably doubting the results. Perhaps you want a closer demonstration? Let’s take a look at the details of this model and see if it really works. First, let’s revisit the rules. Every Friday ...

Read More »Free Trend Following Trading System Rules

Yes, I confess. I wrote that title to mess with search engines. As it turns out, the most popular page on this site, by far, is this one. It’s particularly curious for me, since I keep making the point that trading system rules are overrated. I’ve never come across anyone selling trading rules who actually knows anything about trading. And ...

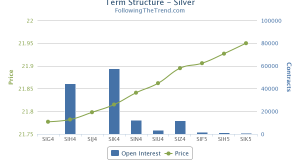

Read More »Term Structure – The forgotten piece of the puzzle

Last week I wrote about the dangers of analyzing the wrong time series. This is still a very common mistake made by traders and analysts and I cannot stress enough just how important it is to get your data right. It’s not a matter of opinion. Just math. Simple continuations without basis gap adjustments are just plain wrong and so ...

Read More » Following the Trend

Following the Trend