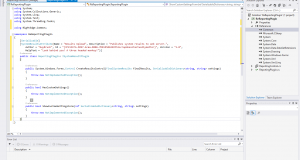

For years, people smarter than me have been telling me to get into Python. I’ve had a perfectly valid reason to resist. It seemed difficult. And besides, just look at the syntax! It looks like some silly BASIC that I used to code back in the 1980’s. It doesn’t even have any semi colons! But slowly I’m starting to see ...

Read More »Author Archives: Andreas Clenow

A Very Different Kind of Trend Model

Trend following is all about following the price. Typically the only input we need for a trend following model is the price. But what if I told that we could make a kind of trend following model which does not use the price direction as an input at all? It also has no stops and no targets. In this article, ...

Read More »RightEdge Automation and Reporting

Please Login to view this content. (Not a member? Join Today!)

Read More »Sophisticated Allocation

Please Login to view this content. (Not a member? Join Today!)

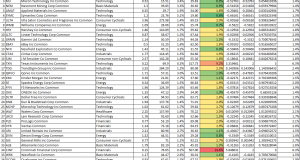

Read More »Advanced Equity Momentum Model

Please Login to view this content. (Not a member? Join Today!)

Read More »Norgate Data for RightEdge Review

I’ve written in the past about how RightEdge is one of the best simulation platforms on the market. The only issue with RightEdge is that it can be a little tricky to get started. If you’re not comfortable with programming, it’s not that easy to get your data hooked up so you can start modelling. Perhaps the new RightEdge plugin for ...

Read More »You can’t beat all the chimps

It is a long established fact that a reasonably well behaved chimp throwing darts at a list of stocks can outperform most professional asset managers. While there would be obvious advantages with hiring chimps over hedge fund traders, such as lower salaries and better manners, there are also a few practical obstacles to such hiring practices. For those asset management ...

Read More »Don’t get burned – Limiting position sizes based on historical volatility

Please Login to view this content. (Not a member? Join Today!)

Read More »Making Your Own Quant Reporting Engine

Please Login to view this content. (Not a member? Join Today!)

Read More »Making a RightEdge Data Adapter

Please Login to view this content. (Not a member? Join Today!)

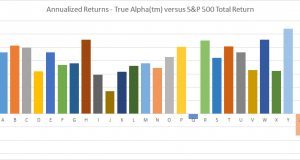

Read More »True Alpha – How the CLENOW portfolio makes a fool out of the S&P 500

Beating the index isn’t really all that hard. I’m going to show you a great way to beat the market while having some fun in the process. This is a brand new way of managing portfolios, and I’m going to explain every detail of it. The True Alpha method is easy to trade and is unique in offering personalized vanity ...

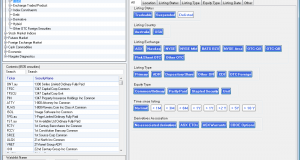

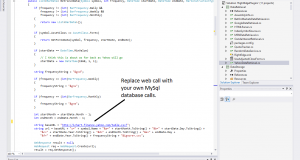

Read More »Setting up your own quant environment – Populating the database

Please Login to view this content. (Not a member? Join Today!)

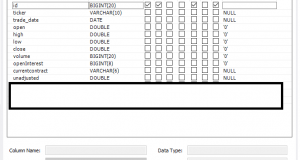

Read More »Setting up your own quant environment – Database

Please Login to view this content. (Not a member? Join Today!)

Read More »How to make proper equity simulations on a budget – Part 2 Software

Your choice of simulation software can have a greater impact than you may think. Most simulation platforms that are priced within reach for hobby traders and even smaller asset managers are quite frankly junk. If you start modeling in those environments, you will most likely either need to throw it all out and start over later, or accept massive error factors. ...

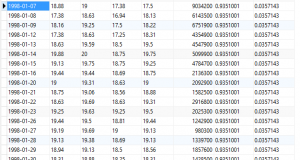

Read More »How to make proper equity simulations on a budget – Part 1 Data

Simulating an equity strategy is difficult. Much more so than simulating a futures strategy. There’s a lot more moving parts to care about. Much more complexity. All too often, I see articles and books that just skipped the difficult parts. Either they didn’t understand it, or they hoped it wouldn’t matter. It does. When I set out to write Stocks ...

Read More »A Random Ass Kicking of Wall Street

A random number generator can beat your mutual fund. Given a choice between a random portfolio and a mutual fund, I’ll go with the randomizer every day of the week and twice on Sundays. You think I’m joking? I’m not joking. Trashing the mutual fund industry is almost like beating a dead horse. Except of course that it’s a thriving, ...

Read More »Beware of Trading Quotes

Retail traders love quotes. Boiling something down to a single sentence makes it appear as a universal truth. A physical law that cannot be broken. It’s a great way to reduce critical thinking. After all, if George Soros said something, it surely must be true. The guy is a billionaire and couldn’t possibly be wrong. Quotes are useless. Pay no ...

Read More »The Stock Investing Illusion

Most people trade stocks because it seems easy. We all know what companies do and how they stock work. At least, that’s what most people would think. It’s a dangerous and deceptive illusion. Equities seem attractive for two reasons. First because they appear simple, and second because of the common belief that stocks always appreciate over time. Both of these points ...

Read More »Stocks on the Move is Out!

A year ago I wrote an article about why trend following doesn’t work on stocks. That article surprised many people. After all, I was mostly known for writing a book about trend following on futures. Why would I diss trend following? And why does a futures guy talk about stocks? The fact is that I’ve been working with stocks longer ...

Read More »Why I am Self Publishing my New Trading Book

I’m one of the top 5% best selling trading book authors in the world. My first book was a run-away success. And yet I’m about to self publish my next work. Why would an established author want to self publish? There is an unjustified perception that self publishing means poor quality. Let me tell you why that’s not necessarily true. Publishing ...

Read More » Following the Trend

Following the Trend