We’ve got some exciting news!

We’re finally ready to share a new project that we’ve been working on for some time! It’s a brand new, modern trading analysis website aiming to help you improve your trading and expand your knowledge.

We’ve been meaning to make a new and modern trading site for some time now. After all, what sense does it make that someone who wrote a book about using Python for financial analysis runs a crappy old WordPress site? WordPress is good platform for simple blogging. Posting mindless articles, much like this one. But as for making high end, interactive data analysis sites, it really leaves some to be desired.

The brand new site, Clenow Research, is built on Python from the ground up. It’s programmed in-house, purpose built as a trading analysis website. Having a proper analysis backend, the site is capable of far more than would be possible on this old site. So let me give you an overview of what you can do on the new site.

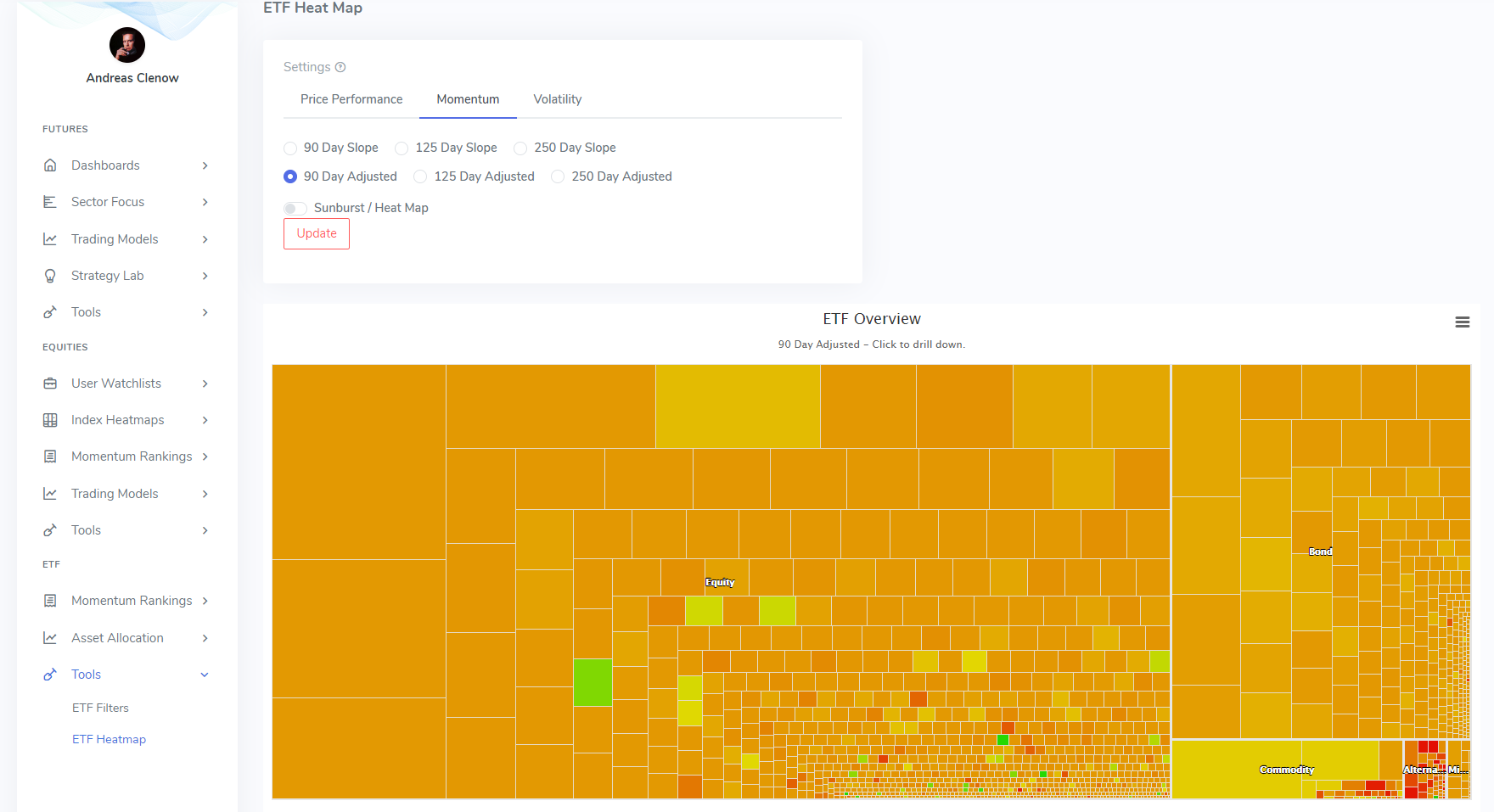

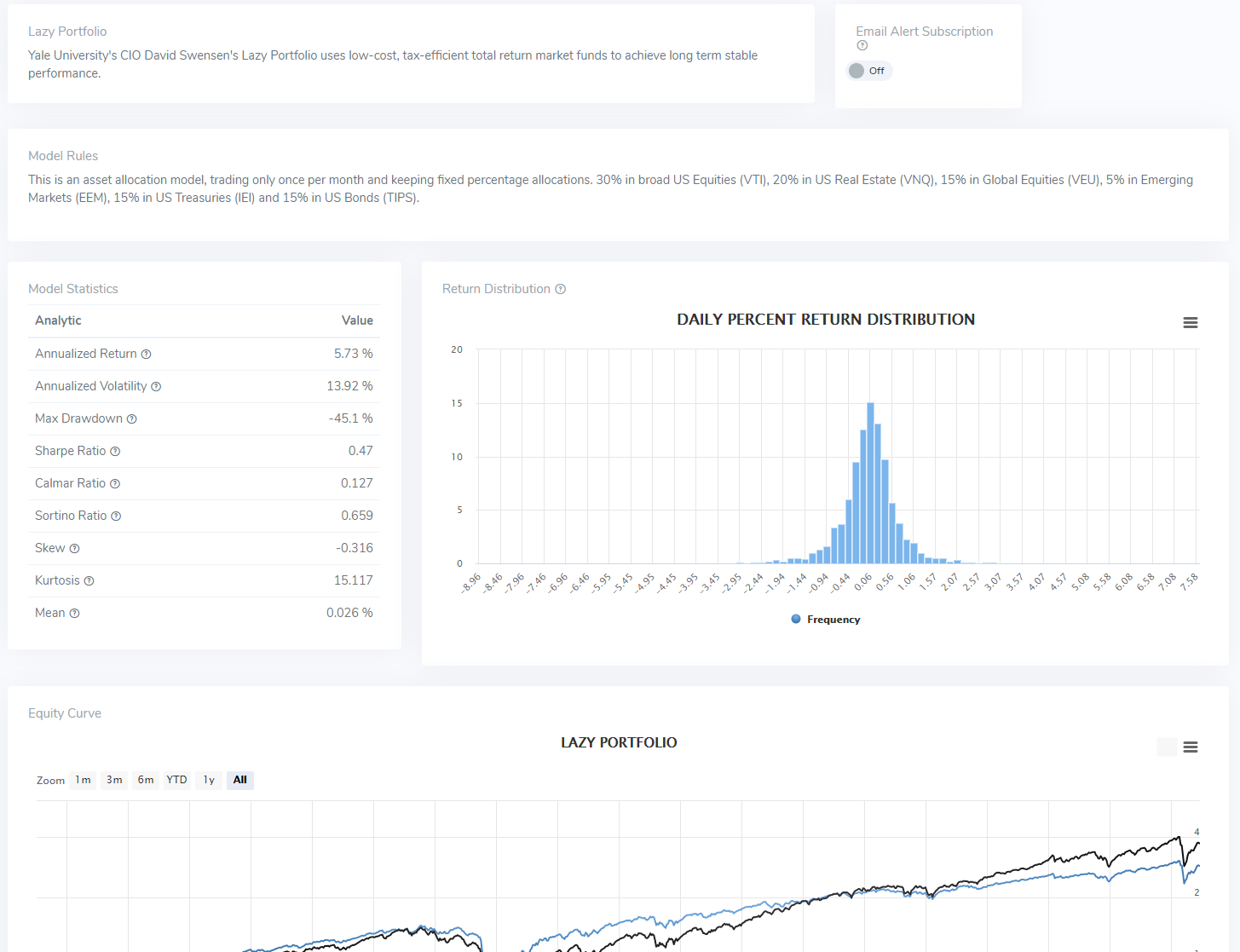

Three are three areas of the site, each with increasing level of coverage and functionality. The ETF area is aimed at long term investors, looking to make rational asset allocation decisions. Covering practically all liquid ETFs, it will help you located performing funds, find trends in sector and country funds, and apply momentum approach on this asset class. You will also get a set of asset allocation models, complete with in-depth analytics, daily trade alert email functionality and more. Everything you need to rationally manage a long term, asset allocation strategy.

Equity Section

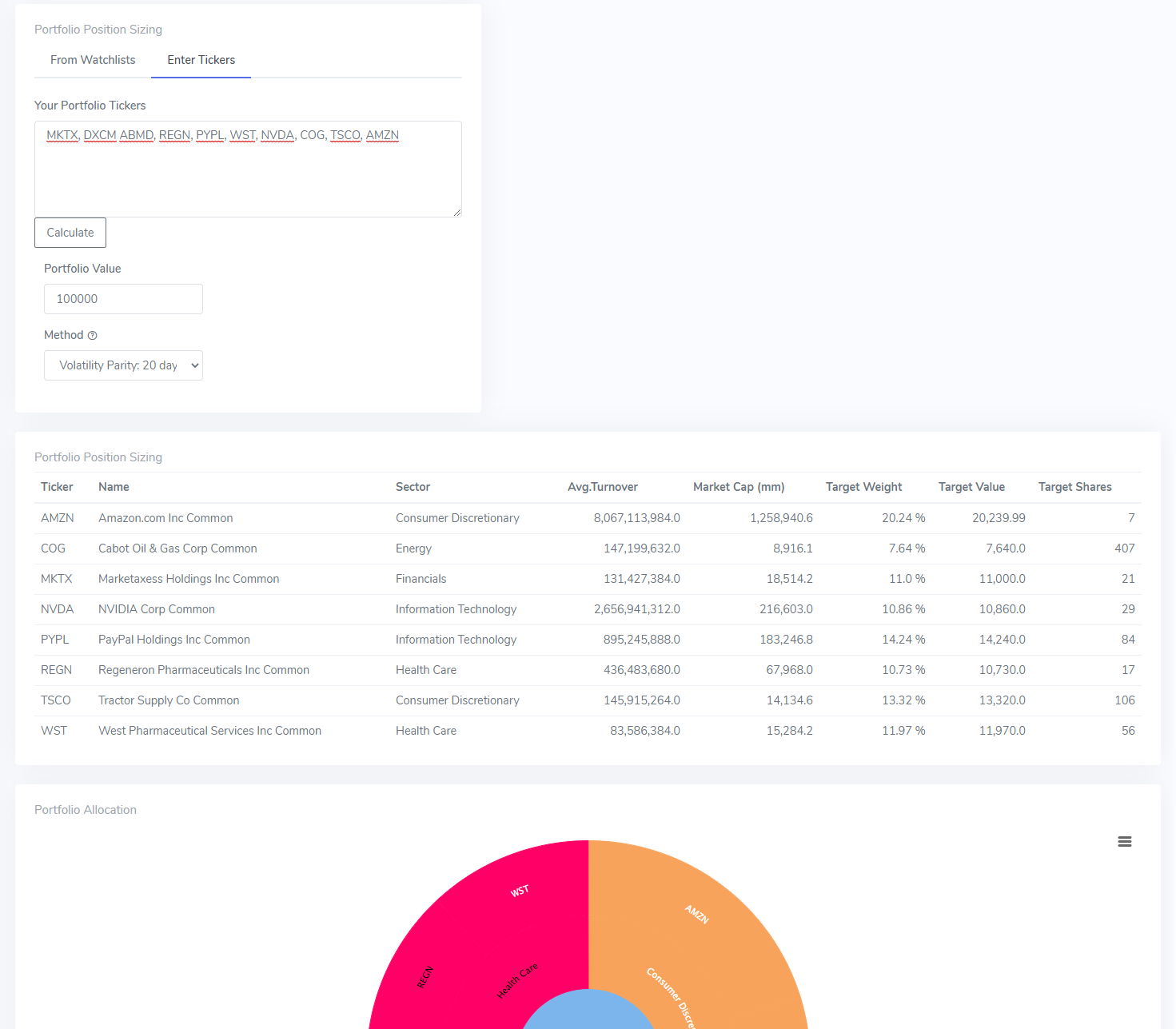

The equity part of the site has a bit deeper contents. Of course you’ll get up date date momentum ranking tables, based on the analytics outlined in Stocks on the Move, but you’ll get so much more this time. You can define your own watch lists and follow how momentum, volatility and trends develop over time. You can see where each stock fits, where it’s ranked compared to its index and sector.

You can use the heat maps and sunburst charts to drill down from a top down perspective and find the strongest sectors and the strongest stocks. They can help you visualize momentum, volatility and more.

The position allocation tools will help you set the position size for your stocks. Enter your stocks, your portfolio value and desired position allocation method, and you’ll get all the sizes calculated for you. And of course, you can subscribe to the daily order alerts from various automated model portfolios. For each stock you get detailed information and peer comparisons.

Futures Section

The futures section aims to be a serious tool for serious traders. There are of course multiple trading models, each with the rules fully explained, plenty of performance analysis and daily email alerts. We’ve also got sections on term structure analysis, quantifying the backwardation or contango opportunities available.

You can do correlation analysis across futures markets with the new correlation matrix and you can analyze peer markets with the pair analysis tool.

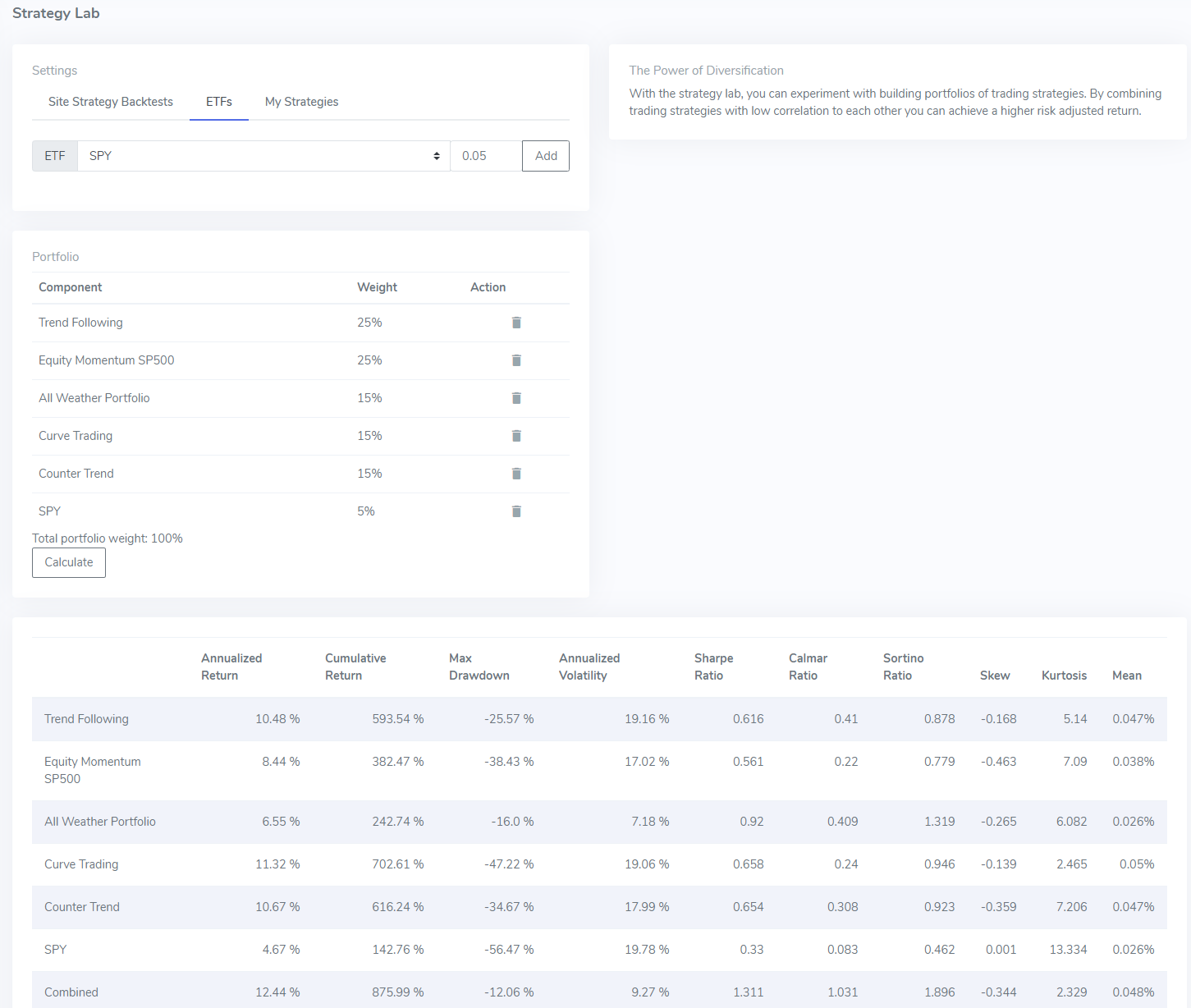

It’s also possible to upload your own strategy returns for a detailed analysis and comparison to the models on the site. But perhaps the most valuable tool so far is the strategy lab, where you can experiment with combinations of strategies. You could see how your overall risk adjusted returns would change if you combine certain strategies at any weights you like, with periodic rebalancing. You can even model how your own trading results could be improved if you add an allocation of trend following, counter trend, curve trading, momentum, or other models on the site. Mix and match as you like, and discover the potential of diversification!

The site is based on Python backend and calculation engines, much like what’s described in Trading Evolved. Recognizing that it’s not feasible for everyone to build such an environment by themselves, we decided to make this tool available.

A Premium Offering

With a considerable amount of work going into constructing this site, we’ve decided to make it a premium offering. We also decided to set the pricing so that it’s very affordable to anyone in the market. Our thought is that the monthly cost is just a trade ticket for most people. A rounding error in what they spend on commissions, tools and research. You’ll get a free trial week of course, so feel free to take a look without any obligations.

Existing Subscribers

If you are currently a paying subscriber to the premium section of this site, you will be able to get access to the new site for the same price while keeping the current access as well. It wouldn’t be fair to ask you to pay twice, would it? We’ll get some mails out to all existing subscribers in the next days with details of that offer.

Going Forward

Constructing this new analysis tool has been quite a challenge, but also great fun. The intention is to keep expanding this site, adding more valuable tools for you guys to use. Now that we have this new platform, we’re going to keep adding features and functionality, making high end trading tools available to everyone. Any ideas and suggestions of what else you’d like to see on the site would be greatly appreciated!

Following the Trend

Following the Trend

Hello Andreas, hope everthing is fine with you.

First of all, I want to thank all your efforts to provide educational and tools that is helping me to learn a lot about systematic trading.

About the new premium tool Clenow Research, I have a question: If I subscribe to the Equity package will I also have access to the premium articles of the followingthetrend.com site?

Thank you.

Best regards

Gustavo

Sure, just ping me after you sign up and I’ll take care of it.