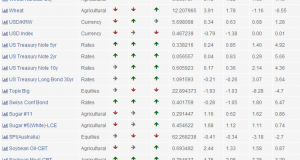

The past few days we have seen a general counter trend market where practically all trends were bucked. The dollar attempted a break on the upside but was pushed back down, the agricultural commodities gained on the dollar weakness as did the non-agricultural ones and as the equity markets saw a couple of positive days the rates futures declined. This kind of market phase is quite normal and don’t get frustrated by the losses that they incur. This is all part of the game and the real difficulty in achieving long term results lay in sticking with the strategy in these rather annoying periods.

The core DTF strategy is now firmly in the negative for the year with a net result of -5%. Most diversified futures programs took a bigger loss than this during 2011 but most of them show a very similar return profile. The fact that this core strategy has outperformed many peers in 2011 does not necessarily mean that it’s a better strategy. The selected time frame and the investment universe can have quite large effects on the bottom line any given year but tends to even out on in the long run. Some years you do better with an investment universe more geared towards agricultural commodities and other years you may do better being more heavy into rates. Avoid falling for the trap of analyzing what asset class weightings worked for the past year or two and adapting your strategy to that, as it does not necessarily have any bearing on the following years. Consistency over the long run is the way to go.

Despite a few trades here and there, all of which are of course shown in the trade alerts section, the portfolio allocation profile remains the same. We are firmly committed to a scenario where the dollar gains, commodities decline and bonds gain. This scenario would also imply that equity markets should suffer or at least not gain too much. There is only one direct short equity position, which is in MSCI Taiwan, but it is unlikely that our portfolio as a whole would gain if the equity market sees a sustained rally in the near future.

| Market | Direction | Sector | Entry Date |

|---|---|---|---|

| Lumber | Short | Agricultural Commodities | 2011-12-01 |

| Rice-Rough | Short | Agricultural Commodities | 2011-11-10 |

| Sugar #11 | Short | Agricultural Commodities | 2011-11-25 |

| Rapeseed(Canola) | Short | Agricultural Commodities | 2011-09-23 |

| Coffee | Short | Agricultural Commodities | 2011-12-13 |

| Wheat | Short | Agricultural Commodities | 2011-09-20 |

| Cotton #2 | Short | Agricultural Commodities | 2011-11-08 |

| Corn | Short | Agricultural Commodities | 2011-11-25 |

| Soybeans | Short | Agricultural Commodities | 2011-11-22 |

| Norwegian Krone/U.S. Dollar | Short | Currencies | 2011-12-15 |

| Swedish Krona/U.S. Dollar | Short | Currencies | 2011-11-28 |

| Euro | Short | Currencies | 2011-12-13 |

| Swiss Franc | Short | Currencies | 2011-11-28 |

| MSCI Taiwan Index | Short | Equities | 2011-11-28 |

| Silver-COMEX | Short | Non-Agricultural Commodities | 2011-12-15 |

| Platinum | Short | Non-Agricultural Commodities | 2011-12-15 |

| Natural Gas-Henry Hub | Short | Non-Agricultural Commodities | 2011-07-08 |

| Heating Oil #2 | Short | Non-Agricultural Commodities | 2011-12-16 |

| T-Bond-U.S. | Long | Rates | 2011-12-19 |

| T-Note-U.S. 10 Yr w/Prj AX | Long | Rates | 2011-12-14 |

| Australian Govt Bond 6%(10Yr) | Long | Rates | 2011-11-21 |

| Australian Govt Bond 6%(3Yr) | Long | Rates | 2011-11-11 |

| T-Note-U.S. 2 Yr | Long | Rates | 2011-12-08 |

| Canadian Govt Bond 10Yr | Long | Rates | 2011-11-24 |

| Euribor 3 Months | Short | Rates | 2011-12-22 |

| T-Note-U.S. 5 Yr | Long | Rates | 2011-12-08 |

| Gilt-Long(8.75-13yr) | Long | Rates | 2011-11-16 |

| Euro Swiss Franc | Long | Rates | 2011-12-08 |

| Euro German Schatz | Long | Rates | 2011-11-10 |

| Euro German Bobl | Long | Rates | 2011-12-15 |

Following the Trend

Following the Trend