Core Trend Following Rules

There are not a whole lot of different ways that trend following can be done. The minor tweaks may have positive results but the effect is usually very minor. If you spend too much time looking at minor variations of entry rules you risk missing the important parts. The truth is that most trend following system rules do the same thing. They show highly similar results simply because they attempt to achieve the same thing. By all means, play around with the detailed rules. Just make sure you do that after you have tried the basic strategy. Understand where the value come from first and you’ll realize just how little the entry rules really mean.

There are not a whole lot of different ways that trend following can be done. The minor tweaks may have positive results but the effect is usually very minor. If you spend too much time looking at minor variations of entry rules you risk missing the important parts. The truth is that most trend following system rules do the same thing. They show highly similar results simply because they attempt to achieve the same thing. By all means, play around with the detailed rules. Just make sure you do that after you have tried the basic strategy. Understand where the value come from first and you’ll realize just how little the entry rules really mean.

The value in professional trend following strategies come from the diversification. The rules presented here are good enough to achieve results on par with the large trend following futures hedge funds. Making the rules more complex does not aid your performance. The most common amateur mistake is to spend all the time tweaking entry and exit rules and not enough analyzing position sizing and investment universe.

The simple rules presented here are good enough to replicate the performance of many large name trend following hedge funds with high precision and correlation. In my book I detail several ways this can be further enhanced and improved upon. Make no mistake though. The trading system rules is the least important component of your trend following trading strategy.

Position Size

Some markets are inherently more volatile than others. To give each position an equal chance to impact the bottom line, positions must be larger for less volatile markets. This can be achieved many different ways. My core strategy uses Average True Range (ATR) for this purpose. ATR measures the average daily price movement of a market. This can serve as a proxy for volatility. Set a target desired daily impact per position. Then calculate how many contracts you need to trade to achieve that based on the ATR. This naturally assumes that volatility remains roughly the same. This is not always the case of course. It’s an approximation and as such it does the job.

For the core strategy on this website I use a desired daily impact of 20 basis points.

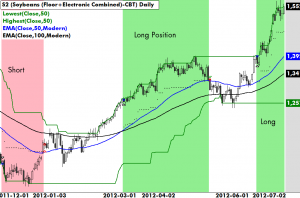

Trend Filter

Long positions are only allowed to be opened if the 50 day moving average is above the 100 day moving average and vice versa. This is to ensure that we don’t put on trades counter to the dominant trend. It reduces the number of trades and lessens the risk of getting caught in whipsaw markets.

Entry Signal

Enter long positions on a new 50 day high. Vice versa for shorts. Go with the breakout and ride the trend. Nothing else. Signals are generated on daily closing data and the trade taken on the open the following day. Slippage is accounted for of course as well as trading costs.

Exit Signal

Exit on three average true range moves against the position from its peak reading. Thereby we have a theoretical loss of 60 basis points. No intraday stops are used, so a close beyond three ATR units are needed for a stop to be triggered the following day.

Investment Universe

Trading a trend following system on a single market or only a few different markets is suicidal. There may be long periods, even years, where there simply are no trends in any given market or asset class. The key idea is to trade many markets covering all asset classes at the same time. If you fail to do so, this strategy will simply not work.

The investment universe you chose will have a much greater impact than tweaking buy and sell rules, so choose wisely. You should chose a broad set of markets and avoid too high concentration in any single sector. In the long run, a healthy balance between all major market sectors yields the best results.

You can study a broad range of markets on the Trends of the World page, which is updated daily with charts and analytics.

Following the Trend

Following the Trend

Thank you for sharing.

I guess you’re using a 100-day period for an ATR as you described in your book, aren’t you? I haven’t found the exact ATR settings in this article. I like the concept of a longer period for an ATR, it gives a smoother results than a shorter ATR like a 14-day one or a 21-day one. Thank you in advance for the clarification. PK

Hi Pavel,

I think I used 100 day, exponential smoothing. It doesn’t matter that much though.

You might also want to look at regular position rebalacing logic. That’s a key important point that I left out of the book to avoid the added complexity.

Hi Andreas,

I would like to know what trading platform/software you are using. I tried a large number of platforms and I haven’t found a professional solution. What platform would you recommend for guys like you? You could also mention a decent brokerage that you are using.

Thank you in advance for any idea!

Regards,

Tom C.

Hi Tom,

I find RightEdge to be one of the very best platforms. The fact that it’s dirty cheap doesn’t hurt either, but that’s not my main reason. http://www.followingthetrend.com/2014/05/why-i-prefer-rightedge-for-strategy-modeling/

We’re using a few of the larger investment bank’s prime brokerage platforms. I’ve tried the usual suspects, GS, JPM, NE etc. Not a whole lot of difference between them, though I wasn’t too happy with the two Swiss investment banks. Choice of broker depends very much on who you are and what you want to do. Obviously, stay away from all the thousands of thousands of con artists operating ‘introducing brokerage’ business. There are lots of them targeting retail market, in particular in the FX space. Use a real broker, with an actual banking license in a trusted country.

In the more accessible segment, I like Saxo Switzerland.

Andrew,

The book doesn’t discuss scaling in/out because you said you view it as a separate strategy. Have you written anywhere about the core strategy with scaling in/out, or increasing the risk factor on winning positions, or increasing position size while maintaining the risk factor?

Thanks, Clay

Hi Clay,

I wrote a little about it here: http://www.followingthetrend.com/2014/07/are-you-trading-or-gambling/

In brief, I find most of these scaling methods to be based on a gambling mindset and a lack of understanding of mathematics. It doesn’t make any sense to change your risk based on your recent success or failure. The probabilities of a crude oil rising next week isn’t dependent on whether or not you have an open profit on it.

Most of us in the business target a certain vola and rebalance regularly to stay close to it.

Pyramiding and such things are strictly amateur.

Thanks Andrew. I understand your sentiments on pyramiding, although I see scaling in a different light, a way of reducing/managing risk instead of increasing it. If prices are non-random and if markets tend to trend, then adding in the direction of the trend seems like a reasonable way to reduce losses, manage whipsaw, and improve the size of profits on winning trades. Dennis and Eckhardt scaled into their positions while still targeting volatility, and I would have assumed that many of their contemporaries and offshoots are/were doing the same. That’s why I was surprised it wasn’t covered in the book. Have I got that wrong?

There’s a reason why I deliberately didn’t mention Dennis, Eckhardt or turtles in my book. I find the whole hero worship culture to be highly irrational and outright dangerous.

Imitating people just serves to reduce critical thinking. It’s great that these people, and many others, made it. Copying strategies developed with pen and paper in the 70s and deploying today is however a very bad idea.

Arguments like ‘Method X must be good because wealthy Trader Y uses it’ isn’t valid. That’s the wrong way to approach a problem. What if Trader Y spends half an hour yodeling in the morning? Perhaps that’s the key to his success?

The original turtle rules have become some sort of weird religion. They have very little in common with the modern CTA industry. Research is moving forward and the business is changing. Also remember that the visible people aren’t always the best. Some of the very best CTA hedge fund managers I know, with billions under management, had never heard of the turtles before I brought the subject up over beer…

The whole culture of worshiping certain traders is very much a retail thing. It’s great for those who sell get-rich-quick dreams, but it won’t help you much if you’re trying to improve your research.

Model the turtle strategy. It’s easy. Curtis released the rules a long time ago and you can download them for free. http://www.followingthetrend.com/mdocs-posts/original-turtle-rules/

Run a backtest on this model for the past few decades. Check how many times over you would have lost all your money. It’s an interesting concept to model and learn from, not the least to learn about how and why it failed.

It’s great that these guys brought research forward in the 70s and 80s. That was a long time ago though and now research has come much further.

My advise is that you listen to ideas from all kinds of sources, but trust none. That includes mine. Then you do your own research. Model the ideas you’ve heard. Test them. Figure out what works and what doesn’t.

Btw, Dennis and Eckhardt wasn’t doing any sort of vola targeting in the old days. Sizing positions based on instrument vola isn’t vola targeting. The latter is about targeting a yearly std.dev on a portfolio basis and requires constant comparison of realized vola to target vola, rebalancing very frequently. A whole different matter, one that wasn’t heard of back in those days.

Andreas,

Thanks the the clarification on portfolio volatility targeting, I hadn’t appreciated that nuance. Your omission of Dennis/Eckhardt seems obvious now, I didn’t even notice it at the time. Would you say that scaling into positions as they did was a flaw (i.e. lowered returns or the quality of returns), or was just an obsolete/unnecessary part of the system?

I don’t believe it’s a good idea for anyone to trade the old turtle rules today, but at the same time I want to be careful with my criticism. It’s easy to say today that the Wright brother had a crappy airplane. Clearly they forgot the jet engine.

These guys, and other lesser known people, laid the ground work. Study it and learn from it. But don’t go jumping off a cliff in a Wright Flyer II.

The original turtle system uses extreme risk. It’s a make or break system, where you’ll either make a ton of money really fast, or more likely lose it all even quicker. It was traded at a time when this system worked really well.

Much of the core ideas from those days are used today, but in a very different way. Just as the ideas of the Wright brothers are still incorporated in airplanes. The business has evolved and matured though.

Hi,

the simulation in the book, and the results, are with (50 & 100) EMA or SMA as trend filter ?

Thanks.

I used EMA, but forgot to mention that in the book. It doesn’t really matter though. Indicators are never important.

The simplified model I showed in the book can be made much more simple. Try a simple X Months Momentum model for instance, where you go long if the price is above X months ago, else short. Amazingly simple, but it captures the bulk of trend following performance.

Thanks.

Classic discussion. Thanks Clay for right questions and Andreas for great answers. Exactly had similar questions but Clay put it way better here

Hello Andreas,

First of all, thank you. I am very impressed by the materials on your website, I plan to buy your book, and I am very greateful for the information you shared.

I am searching for a mechanical end-of-day trading system that I could follow with confidence and discipline.

I have a few years of discretionary trading experience, but no consistent profits.

I backtested the system you describe here, with Amibroker.

Markets I used: Copper, Gold, Corn, Natgas, Oil, Rice, Soybean, Wheat, AUDUSD, EURUSD, GBPUSD, NZDUSD, USDCAD, USDJPY, S&P500, TNOTES10, Bund.

I tested it from January 2000 to July 2015, with end-of-day historical data for all the markets listed above.

I would like to present the results of my research and I hope you will be willing to answer my three questions.

In short, your system made money.

However, based on the optimization, it seems better parameters for my markets choice were EMA 150 and EMA 350, and entry on 120 days high or low. (instead of 50, 150 and 50 respectively). 3 ATRs remains best.

My “better” parameters did not increase profits, but they cut the drawdown by half!

Questions

1. Even with my improvements, the CAR/MDD for my backtest is 0.50.

Compound Annual Return 8%, Max Drawdown 16%.

This is with position size based on volatiliy, target risk $2k per trade on a 100k account.

I estimated a quite conservative spread and comissions.

Is this good enough?

Does it look like acceptable result to you?

What was CAR/MDD measure for this system in your backtest, or with systems you actually trade, if I may ask?

2. The equity curve had a almost 5-year long drawdown period, from 2009 to 2014.

I know this was not the best time for any trend following system, but I anticipate it will be very hard to stick to this system should a new drawdown like this happen.

Do you think this 5 years drawdown is at all acceptable?

Here is the link to my backtesting report with equity curve screenshots. Have a look for EQUITY CURVE charts.

https://docs.google.com/document/d/1b2zQMhXVcvo1YmHsCM246hjbkbLgsa4WyF6rXBN-aBU/edit?usp=sharing

3. Shall I trade all markets using common rules?

I understand I should not curve fit EMAs and channel and ATRs for each market… I know… but maybe it is valid to have separate rules for stock indices and rates and separate for commodities and forex?

This system, per my backtestst, was losing money on S&P, TNOTEs, DAX and Bunds.

So I excluded these markets from portfolio. (To make money on S&P it needs shorter EMAs and wider stops, like 7 ATRs, but then it makes less money in commodities and forex).

Shall I trade it on commodities and forex with my paramaters? (and skip S&P, DAX, TNOTE and BUNDs)

Or should I keep searching for a system that makes money on ALL markets?

Did it make money on ALL markets in your backtest?

I’d be delighted to hear back from you.

Thanks a lot in advance!

Michal

PS. I enabled comments on the file I shared abouve, so you can comment it as you review it. Thank you!

additional comment to my own comment… I found this article by the author of this very blog… https://www.tradingfloor.com/posts/did-trend-following-just-die-again-5101075

… in which he presents the simulated equity curve of this core trend following system, until mid 2015.

and… his equity curve looks very similar to my version (although I used different set of markets (ones I have access to) and different parameters (longer EMAs after optimization). This similarity, I think, has two implications. 1. my backtest was correct, 2. the 5 years of drawdown was real.

Comments? Thanks a lot. I pasted the link also to the document I linked in my comment above. I hope this is insightful for others as well… and I am looking forward to comments.

Hi Michal,

Sorry for long delay.

I don’t really have the time to do a proper evaluation of your model. Keep in mind that the model I describe is a demo model used to approximate what the CTA industry has been doing for the past few decades. It’s not meant as a recommended super model of any sort. It’s quite easy to improve upon it, but I wanted to keep it simple and middle-of-the-road to make a point. In fact, my only regret is not making the model in the book even simpler. If I had used the good old 12 months momentum model, perhaps that point would have been more clear.

A five year drawdown is not acceptable. But it could still happen. You won’t be able to keep clients if you’ve spent five years under water. It could absolutely kill your business, but it’s near impossible to make a model that guarantees it will never happen.

I would recommend trading all markets with the same rules. That of course doesn’t prevent you from making rules that adapt to term structure, volatility, trends etc. Making a rules that says ‘Trade these parameters for Corn’ is a bad idea. Making rules that adapt to market characteristics could make sense.

Also, you’ll never make money on all markets. But you don’t have to. Any individual market or position is irrelevant. The only thing that matters is the end result. Since you don’t know which markets will perform and which will not, you’ll have to trade them all.

Hope that helps…

Hello Andreas, bought and read both your books, great stuff.I’m however beginning to think I’ve misunderstood something:When you write “desired daily impact of 20 basis points” , are you saying risk 0,2 % of your equity per atr of sl= 0,6% total per position for a 3atr stop? That is what I’ve thought so far but I’m beginning to think thats not the case?

Also, when we’re talking risk per position, do you think it should be based on only the cash amount in the account? I find that I often have rather large open profits while the small losses eat away at the cash, leaving me with smaller and smaller position sizes.

Regards:Bengt

Hi Bengt,

Risk has nothing to do with stop distance. That’s a misunderstanding usually perpetuated in trading books written by people who don’t really understand finance.

The 20 basis points is average daily portfolio attribution. If the instrument in question maintains current volatility (which is a huge assumption), then it will on average have an effect on the overall portfolio of 0.2% each day. Up or down.

Risk absolutely needs to be measured on a portfolio level. The amount of available cash is irrelevant to such calculations.

Andreas

so does the above mentioned rule state that each position has a 3atr volatility upon entering a trade?ie 0.6% risk on such trade?

Thanks a lot, I read Curtis Faiths book (good , by the way) prior to yours and assumed you meant something similar. can you recommend further reading?

I know Curtis. He’s an honest guy. He’s a little odd, but I take an honest odd guy over the usual con men any day. Of course, keep in mind that Curtis stopped working in trading around age 23, over 25 years ago.

The trick is to identify who knows what they’re talking about and who makes it up as he goes along. It can be difficult to see on the book covers, but often it’s given away by the author description. “XX has had a passion for trading for 20 years”, means that he doesn’t have any actual background in the business. “Developed trading systems and managed proprietary capital for 20 years” also means that a person never worked in the field. There are many of these usual ways authors describe themselves to cover the total lack of real background. It always also shows on the terminology that they use. Dead giveaways include how they define risk, which is usually complete guesses of what the word means, such as “how much money will i lose if the price falls down to my stop point”. Try suggesting that at a job interview as a risk analyst and you’ll get a good laugh on the way out the door.

Read books by Meb Faber, Katy Kaminski, Ernie Chan and such people to get the bigger picture. Most retail level trading books just muddle the picture.

Thanks for taking the time. I have 25 years experience in engineering, product development and one thing trading and my profession have in common is: I don’t get away with anything in neither! Whether trying to cut corners or being ignorant, it always catches up to me and maybe that is why I like trading on a very basic level: I can’t bullshit the market, the facts rule and that makes it the most honest environment I’ve ever experienced.

Does these rules / trendfollowing sytem also work on smaller times frames ? A hourly timesframe ?

Hi Andreas. It’s a timepiece of an article. Thank you.

I’m a newbie and I’ve dedicated a lot of time to learning from my mistakes (cost me 50% of my account, tuition fees I’d say). Over Reliance on indicators and terrible multiple time frame analysis, poor risk management at times. You name it and I’ve made those mistakes.

Now I just watch out for price action and trends using other confluence factors like EMA. It’s simple yet effective.

How do you put tighter stops without getting stopped out, because sometimes I get stopped out with retracements from prevailing trends. I want to improve my risk to reward ratio which is now usually between 1:1 and 1;2? Sometimes the previous swing lows on larger time frames are too large and on smaller time frames seem like noise?

Hi Andreas. Do you think this estrategy also work in weekly timeframe? Or trading once a week? Thank you

Hi Andreas,

Love that book, I’ve currently coded the strategy in Amibroker using Norgate/Premium Data futures for the data. I’m having some difficulty in getting the position sizing correct for the risk parity weighting in the futures mode, are you able to point me in the right direction of where I can find some help on this?

Many thanks,

James

Hi Andreas,

I have been following your work for awhile. Really good stuff.

May I ask, how do you manage trades that are stopped out by your 3 ATR rule, but rebounded almost immediately and carry on to trend really well in the original direction resulting in a major trend?

Since not missing a major trend is so important to this strategy, would you use a re-entry rule?

Cheers,

Andy

So are we going to trade the breakout of 50 days high and low without waiting for a minor pullback for a better price?

Will this strategy work on lower time frame on the hourly for example